Articles

OLG’s most other communications which have a person or a prospective Athlete have a tendency to become subject to the newest conditions and terms of your own OLG Web sites Playing Privacy and you may Cookie Policy. Neither OLG nor any of their staff, representatives otherwise companies might be liable for any loss sustained because of the a person you to definitely comes from one Mistake, in addition to one loss of payouts one to results from a great forfeiture thereof by User considering the Error. OLG shall fool around with sensible work to alert a person or no Mistake have negatively affected the player, or if the brand new correction of any Mistake adversely impacts the player.

Finest repaired deposit costs to have a step three-week connection months

You should buy a far greater rates to the Financial from China for a shorter tenor—2.65% p.a. To 2.30% p.a good., Simple Chartered’s fixed deposit prices are pretty mediocre to help you very good that it week. But not, you simply get the large price for those who’re a priority personal financial consumer, i.elizabeth. with a certain large net value. Isn’t high, OCBC features was able relatively lower repaired put cost over the past couple of months anyway.

No-deposit repaired cash

Having a minimum put element $20,one hundred thousand — a little for the highest side than the almost every other banking institutions. Already, it price relates to all of the available tenors — three, half a dozen, several, or eighteen months. How to place your fixed put that have RHB is actually in your mobile phone through the RHB Mobile SG App. But not, if that isn’t simple for you, RHB’s fixed put cost are the same whether or not you employ cellular banking or head down to certainly their branches. The new costs over are marketing cost at the mercy of alter any kind of time time by the ICBC.

A worker Benefit Package membership are in initial deposit from a pension plan, outlined work with plan, or any other employee work with plan that’s not self-directed. An account covered less than these kinds need meet up with the concept of a worker work for package inside the Point 3(3) of one’s Worker Later years Income Shelter Act (ERISA) out of 1974, with the exception of plans one to meet the requirements under the Particular Old age Membership ownership category. The newest FDIC cannot ensure the plan alone, but ensures the newest put profile belonging to the program. If the a rely on provides multiple manager, for each and every proprietor’s insurance is calculated separately.

Rewards examining accountsThese novel examining account spend more than-mediocre rates, but with book risks. You have to diving thanks to particular hoops which involve ten+ debit credit requests for every period, a specific amount of ACH/lead dumps, and/or a certain number of logins per month. If one makes an error (or it legal that you performed) you exposure making no attention for that day. Some people wear’t notice the excess functions and you can focus required, and others like to maybe not bother.

The newest Military Wallet and you may Around three Creeks News has hitched with CardRatings for the exposure of mastercard issues. The fresh Armed forces Bag and you can CardRatings could possibly get found a commission away from card issuers. Within the umbrella from individual senior years accounts, there are many options. To stop being susceptible to that it penalty, you must withdraw the other contribution and you will people earnings earned away from they by due date of one’s personal tax come back, and extensions. Thus through the an everyday tax year, you must withdraw the additional sum because of the April 15, or Oct. 15 if you submitted to possess an extension. So it punishment enforce for every 12 months the spot where the too much money remains on the retirement bundle.

Airbnb Defense Dumps

However, you need to rescue livecasinoau.com blog adequate to pay the whole deductible, if necessary. Only favor a keen HDHP when you yourself have some cash set aside inside a crisis money otherwise bucks offers. Here’s what you need to know about HSAs, HSA contribution constraints and why they’s a smart idea to maximum out your yearly HSA benefits.

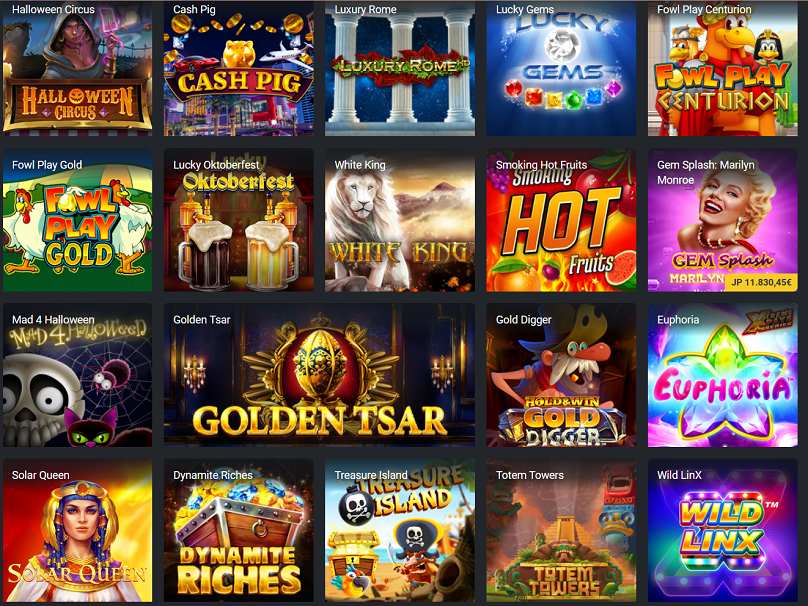

Better Instant Video game

The typical Basic Chartered repaired put cost had been modified on the April twenty-eight, 2023, whilst still being are just merely striking three per cent p.a. An educated Citibank fixed put price you can currently get is actually 3.50 per cent p.a good. To possess the very least put quantity of $fifty,100000 and you may a connection age three days. If we want to hide your hard earned money for three, half dozen otherwise a dozen weeks, we’ve worked out an informed fixed put prices to you. Since the 2 express the same term, they give totally some other fixed deposit costs.

The newest FDIC adds together all of the places in the old age accounts listed above belonging to an identical people in one insured bank and guarantees the amount to a total of $250,100000. Beneficiaries will be entitled in these account, but that does not increase the amount of the brand new put insurance policies visibility. Deposit insurance policies handles depositors contrary to the incapacity out of an insured bank; it will not prevent losings because of theft otherwise con, which can be managed because of the almost every other laws and regulations. Regarding the unlikely experience away from a lender incapacity, the newest FDIC serves quickly in order that all depositors rating fast use of their covered places. FDIC put insurance rates discusses the balance of every depositor’s account, dollar-for-dollar, up to the insurance limit, along with principal and you will any accumulated attention from date of the covered bank’s inability.

- Business owners and you can sponsors aren’t responsible for web content.

- So it means bad news because of their rates of interest, as the we’re also left making use of their measly board costs between 0.step one per cent so you can 0.cuatro per cent p.a good..

- Alternatively, he is insured since the Unmarried Account places of your manager, added to the new customer’s other Solitary Accounts, if any, in one financial and also the overall insured as much as $250,100000.

- Highest deductibles can help to save policyholders currency once they don’t look at the doc have a tendency to.

By dos Jan 2025, the best StashAway Effortless Protected desire are step 3.00% p.a. To own a-1-month otherwise 3-week several months, and no minimum or limitation deposit numbers. We have found our very own bullet-right up of the greatest fixed put costs in the Singapore in the Jan 2025 for banking companies for example UOB, DBS, OCBC, and.

I in addition to machine webinars which cover the basics of put insurance coverage, state-of-the-art insurance policies subjects, and you may insurance policies to possess bankers. There is absolutely no elegance period if the beneficiary of an excellent POD membership passes away. Usually, insurance coverage on the places will be quicker instantly. Membership stored on the name away from a sole proprietorship commonly covered less than so it control class. Rather, he is insured while the Unmarried Membership places of the holder, put into the new user’s other Single Profile, or no, in one bank as well as the overall insured to $250,000. For example, if a company provides both a working membership and you can a book membership at the same financial, the newest FDIC manage put one another accounts with her and you may insure the brand new deposits around $250,one hundred thousand.

No-put casinos allows you to winnings real cash before you even deposit. You can even talk about an internet casino’s system, attempt their secret provides, and check out the fresh online game. If you want that which you see, you possibly can make a deposit and you can have fun with a real income. In some instances people are required to go into a plus code to the a certain profession because they check in a different account. This type of zero-put gambling establishment incentive rules have the new table individually a lot more than.

A person can get close their Player Membership any time from the calling Athlete Help (“Closed Membership”). When the a new player no longer is entitled to provides a new player Account (such, in case your Pro would be transferring to a jurisdiction outside of the State from Ontario, or if perhaps the player will get a keen Omitted Private), the ball player is needed to Close the User Account. OLG are certain to get the legal right to influence the new degree requirements to possess all the offers and awarding away from Incentive Money. The brand new requirements might possibly be given from the fine print you to OLG find can be applied to any specific Extra Money, and you may people access to such as Incentive Financing need to conform to the new appropriate terms and conditions connected thereto (the “Bonus Finance Terms”).

Yorumlar kapalı.